About Govt. GST Details

GST Details

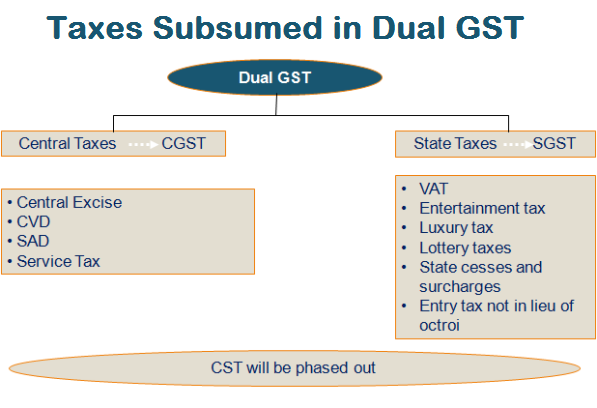

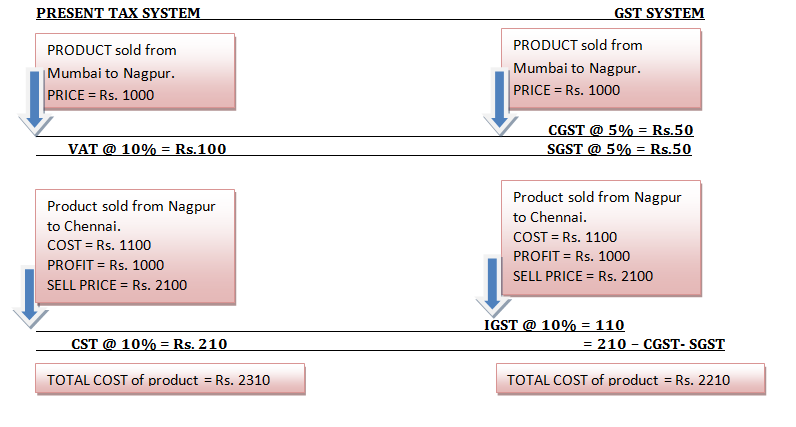

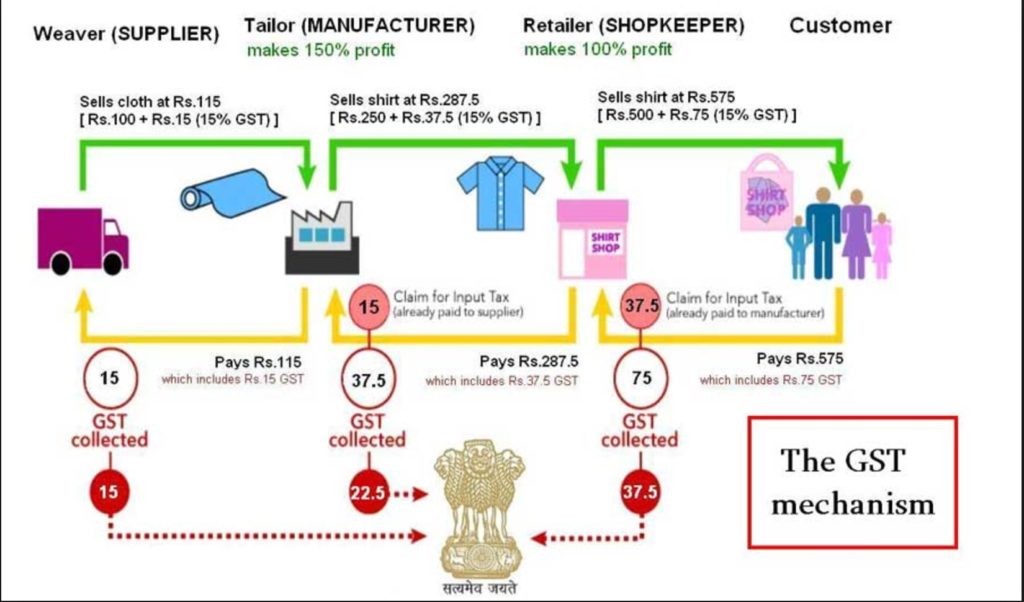

1.GST (Goods and Services Tax) is a tax levied when a consumer buys a good or service. The current tax regime is riddled with indirect taxes which the GST aims to subsume with a single comprehensive tax, bringing it all under a single umbrella.

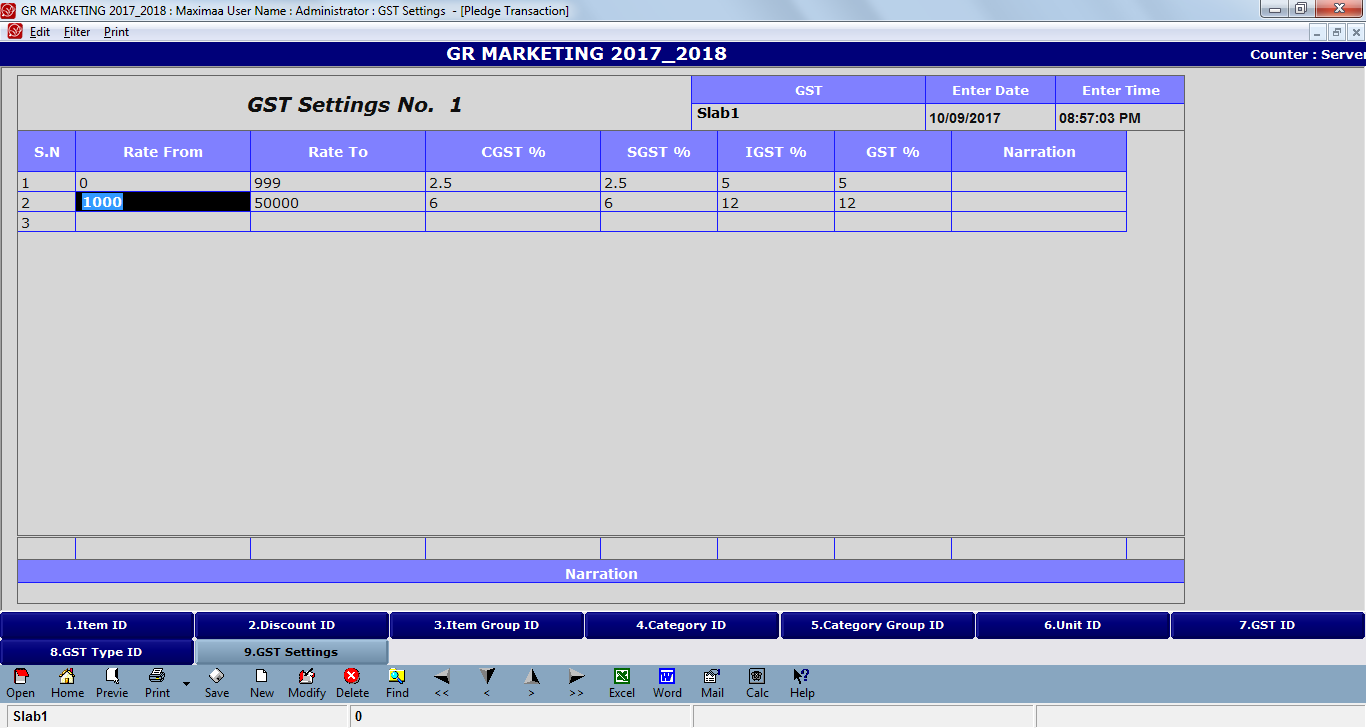

2.Central GST (CGST) which will be levied by Centre

State GST (SGST) Which will be levied by State

Integrated GST (IGST) – which will be levied by Central Government on inter-State supply of goods and services. IGST is charged when movement of goods and services from one state to another.

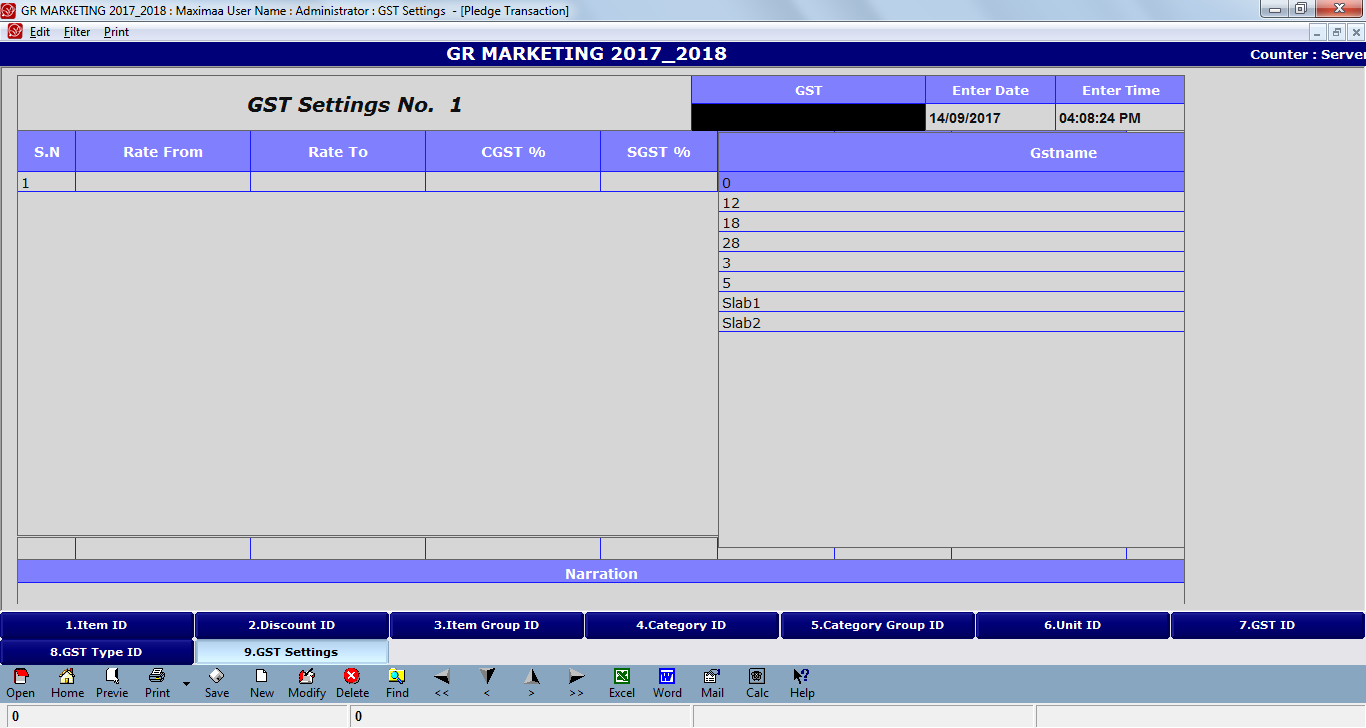

3.Under GST, goods and services are taxed at the following rates, 0%, 3%, 5%, 12% ,18% and 28%.

Input Tax Credit (ITC) Mechanism

E-Filer Meaning Scope of Supply

GST Council’s Recommendations -23rd Meeting

In the GST Council meeting on 10th November, ’17, various decisions were taken with the view to make compliance easier for small tax payers, make composition scheme more attractive for tax payers and reduce the household expenditure for consumers. Let us understand the GST Council’s recommendations in detail:

Return filing

1.GSTR-3B filing to be done till March ‘18

GSTR-3B, a summarised monthly return, should now be filed till March ’18. Earlier, Form GSTR-3B was applicable only till December ’17. Filing of GSTR-3B and payment of tax should be done by 20th of the succeeding month.

2.Quarterly filing of GSTR-1 for persons with aggregate turnover upto Rs. 1.5 Crores

Persons whose annual aggregate turnover is upto Rs. 1.5 Crores can file GSTR-1 on quarterly basis, as per the calendar below:

| Return Period | GSTR-1 filing date |

| July-Sep ‘17 | 31st Dec ‘17 |

| Oct-Dec ‘17 | 15th Feb ‘18 |

| Jan-Mar ‘18 | 30th April ‘18 |

3.Relaxation in GSTR-1 filing date for persons whose aggregate turnover exceeds Rs. 1.5 Crores

Persons whose annual aggregate turnover exceeds Rs. 1.5 Crores have to file GSTR-1 on monthly basis. However, the due dates have been relaxed as given below:

| Return Period | GSTR-1 filing date |

| July-Oct ‘17 | 31st Dec ‘17 |

| Nov ‘17 | 10th Jan ‘18 |

| Dec ‘17 | 10th Feb ‘18 |

| Jan ‘18 | 10th Mar ‘18 |

| Feb ‘18 | 10th April ‘18 |

| Mar ‘18 | 10th May ‘18 |

4.Revised due dates for other GST forms

The due dates for certain forms has been revised as given below:

| Form | Due Date |

| GST ITC-04 (Details of inputs/capital goods sent/received from job worker) | 31st Dec ‘17 |

| GSTR-4 (Return for composition tax payers) for July-Sept ‘17 | 24th Dec ‘17 |

| GSTR-5 (Return for non-resident tax payers) for July ‘17 | 11th Dec ‘17 |

| GSTR-5A (Return for online information and database access/retreival service providers) for July ‘17 | 15th Dec ‘17 |

| GSTR-6 (Return for Input Service Distributors) for July ‘17 | 31st Dec ‘17 |

| TRAN-1 (Application for claim of transitional input tax credit) | 31st Dec ‘17 |

5.Credit of late fee paid for late filing of GSTR-3B for July, August & September ‘17

The late fee applicable for late filing of GSTR-3B for July, August and September ’17 had earlier been waived by the Government. Tax payers who have already paid the late fee for these months will receive a credit of the same in their Electronic Cash Ledger under the respective Tax head. This can be utilized for paying future tax liabilities.

6.Reduction in late fee for late filing of GSTR-3B for persons with Nil tax liability

Persons who have Nil tax liability in GSTR-3B from October ’17 onwards have to pay late fee of Rs. 20 per day for late filing of GSTR-3B. Earlier, this was Rs. 200 per day.

7. Due dates for filing GSTR-2 and GSTR-3 for July ’17- March ‘18 will be decided

The due dates for filing GSTR-2 and GSTR-3 will be decided by a Committee of officers. However, filing of GSTR-1 and GSTR-3B has to be done as per the due dates. For the period of July ’17 to March ‘18, filing of GSTR-1 will be allowed to be done without filing GSTR-2 and GSTR-3 for the previous month.

Registration

1.Exemption from mandatory registration for persons providing services through e-commerce operators

Persons making supplies through e-commerce operators were earlier required to mandatorily register, irrespective of their turnover. Now, persons providing services through e-commerce operators have been exempted from mandatory registration. This means that persons providing services through e-commerce operators now need to register only when their turnover crosses the threshold limit of Rs. 10 Lakhs (for special category States, i.e. Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand) and Rs. 20 Lakhs (for rest of India).

Composition scheme

1.Rate of tax to be 1% for manufacturers

Earlier, manufacturers were required to pay tax @2% of their turnover. This has now been changed to 1%.

2.For traders, tax to be paid only on value of taxable supplies

Under the composition scheme, tax is to be paid as a percentage of turnover. For the purpose of payment of tax under the composition scheme, turnover is calculated as total of taxable supplies + exempted supplies. Now, it has been decided that traders need to pay tax @1% only on value of taxable supplies. Value of exempted supplies will not be considered for calculation of turnover of traders for the purpose of payment of tax. Note that this change is only in the calculation of turnover of traders for payment of tax. The calculation of turnover for registration remains same for all- value of taxable supplies + exempt supplies + exports.

3.Composition tax payers can supply services upto Rs. 5 Lakhs per annum, which will be exempted from tax

Previously, except restaurants, service providers were not allowed to register as composition tax payers. Now, persons registered as composition tax payers can supply services upto Rs. 5 Lakhs per annum. This supply will also be exempted from tax.

4.Threshold limit to register under the composition scheme increased to Rs. 1.5 Crores

Recently, the threshold limit for a person to register under the composition scheme was increased to Rs. 1 Crore in all States except special category States. This has now been further increased to Rs. 1.5 Crores. This means that persons whose turnover does not exceed Rs. 1.5 Crores are eligible to register as composition tax payers.

GST rates

1.Only 50 items will now attract 28% GST

The list of items falling in the 28% GST rate list has been pruned and only 50 items will now attract 28% GST. Items in the 28% GST category whose rate has been reduced include detergents, furniture, shampoos, wrist watches and chocolates. Goods like washing machines, refrigerators, majority of construction materials, cement, automobiles have been retained at 28%.

2.Restaurants

- All stand-alone restaurants, whether air conditioned or not, will attract 5% GST, without Input tax credit (ITC). Food parcels or takeaways will also attract 5% GST, without ITC.

- Restaurants in hotel premises where room tariff is less than Rs. 7,500 per unit per day will attract 5% GST, without ITC

- Restaurants in hotel premises where room tariff is Rs. 7,500 and above per unit per day will attract 18% GST, with full ITC

3.Reduction in GST rates for other items

13 items have been moved from 18% to 12%, 6 items from 18% to 5%, 8 items from 12% to 5% and 6 items from 5% to nil.

Hence, the GST Council’s recommendations in this meeting are helpful for small businesses. Composition scheme has been made more attractive with the recent measures. GST rate reduction for various items has been focused on consumers and reducing their household expenses. The extension of return filing dates is a positive measure which will give businesses sufficient time to effectively comply under GST. Overall, these measures will ease the compliance burden for taxpayers as well as bring greater savings for consumers.

Highlights of 23rd GST Council Meeting:

- Relief in GSTR compliance

- All businesses to file GSTR-1 and GSTR-3B till March 2018

- GSTR-2 and GSTR-3 filing dates for July 2017 to March 2018 will be worked out later by a Committee of Officers

- GSTR 4 due date for July to September extended to 24th December 2017

- Changes in Composition Scheme

- Composition scheme limit to be increased to Rs 1.5 crore (can be extended to Rs 2 crore later)

- 1 % GST rate for manufacturers & traders

- Composition Returns, GSTR-4 due date extended to 24th December

To see detailed changes in dates for GST return filing for July 2017 to March 2018.

- Changes in GST Rates W.e.f. 15th Nov 2017

- Only 5% GST (instead of 12% & 18%) on food bills in restaurants

- Reduced from 28% to 18% - Shampoo, Perfume, tiles, watches

- Reduced from 28% to 12% - Wet grinders, tanks

- Reduced from 18% to 12% - condensed milk, refined sugar, diabetic food

- Reduced from 12% to 5% - desiccated coconut, idli dosa batter, coir products

- Reduced from 5% to nil - guar meal, khandsari sugar, dried vegetables

To see detailed list of all the products whose GST rates are changed.

- Late Fees reduced

- For delayed filing of NIL returns, late fee reduced from Rs 200 per day to Rs 20 per day

GST on free samples, buy one get one free, free supplies

GST on Free Samples, Supplies and Buy One Get One Free Offers

Festival season is around the corner, sales promotional offers will be a common sight in the market place. More often, promotional schemes are used as effective sales strategy to attract the customer to buy their product. Among the various promotional offers, Buy One-Get One Free, Free gifts, Flat discounts, and so on, are the popular schemes. In case of newer products, in order to gain market penetration, the concept of free samples are adopted. Under this, products are supplied for free as a sample, and this is very common in the pharmaceutical industry. While this method of sales is proven to be successful, it is not as easy for businesses as it looks. In deciding the promotional offers, the businesses need to consider the implication of taxes on these schemes.

The treatment of tax for free samples and supplies under GST is more or less similar to VAT regime. Under GST, anything supplied as ’Free’, tax will not be levied on such supplies. However, on doing so, businesses need to sacrifice the benefit of input tax credit. This means, businesses will not be entitled for input tax credit on the goods, which are supplied as ’Free,’ and proportionate ITC needs to be reversed.

Let us understand GST on free supplies with an example

Electronic World is an exclusive showroom of electronic products. They purchase 49 Inch and 22 Inch LED TV from their distributor. The following are the details of inward supplies:

| TV | QTY | Rate | Amount | GST |

|---|---|---|---|---|

| 49 Inch LED TV | 10 Nos | 50,000 | 5,00,000 | 1,40,000 |

| 22 Inch LED TV | 10 Nos | 10,000 | 1,00,000 | 28,000 |

Electronic world announce festival offers. One such offer is, Buy 49 Inch LED TV and GET 22 Inch LED TV Free. Now, how will the free supplies be treated in GST?

As discussed earlier, on free supplies, GST will not be levied. As a result, on making outward supplies of 22 Inch Led TV as free, GST will not be charged. However, Electronic World needs to reverse the ITC claim of Rs 2,800 on the inward supply of 22 Inch Led TV.

Similar treatment needs to be done in the event of goods are stolen, destroyed, written-off or disposed of as gifts,

Conclusion

The GST era has not brought in any significant change in the behaviour of free supplies. The provisions of the erstwhile law of VAT is replicated. However, caution should be taken to ensure that the reversal of ITC are accounted for periodically as applicable. This is to avoid interest or penalty in case of detection of non-adherence by the tax authority.

Guide to File Form GSTR-3B, GSTR-1, GSTR-2 & Match GSTR-3B with GSTR-1, GSTR-2 and GSTR-3

Guide to File Form GSTR-3B

The 17th GST Council meeting held on 18th June, 2017, provided a much needed relief to the businesses across the nation. Listening to the concerns raised by the various trade and industrial bodies, and to ensure the smooth roll out of GST, the council decided to extend the timeline for invoice-wise return filing in Form GSTR-1 and Form GSTR-2 for the first six months (Revised).

For the first 6 months – July’17 to December’17, businesses need to file a simple return in Form GSTR-3B by declaring the summary of inward supplies and outward supplies. However, the invoice-wise details in Form GSTR-1, Form GSTR-2 and GSTR-3 are required to file as per notified dates.

The revised return dates will provide an additional 25 days’ time for businesses to equip and settle with the various requirements of new indirect tax system. In addition to the above, no late fees and penalty would be levied for slippage in return filing for the interim period.

Form GSTR-3B consists of 6 Tables. You need to capture the consolidated details of outward supplies, inward supplies, eligible ITC, and the details of tax payment. Let us discuss this in detail:

1. Details of outward supplies and inward supplies liable to reverse charge

In the above table (3.1), you need to capture the total taxable value (both intrastate and interstate) of the following Nature of Supplies along with the total tax (IGST, CGST, SGST/UTGST) as applicable:

- Outward Taxable Supplies other Zero Rate, Nil Rate and Exempted

- Outward Taxable Supplies (Zero Rated)

- Outward Supplies towards Nil Rated and Exempted

- Inward Supplies liable to be paid on reverse charge basis

- Non-GST Outward Supplies

2. Details of inter-State supplies made to unregistered persons, composition dealer and UIN holders

From the outward supplies details declared in table 3.1, discussed in point No. 1, you need give a break-up of the interstate outward supplies made to Unregistered Persons, Composition Dealers and UIN Holders. These details needs to be captured State-wise/ Union-Territory-wise total with taxable value and total IGST levied on these supplies.

3. Details of eligible Input Tax Credit

In the above table, you need to capture the details of ITC availability, ITC to be reversed, and arrive at the Net ITC available. The following are the details you need to capture:

1.ITC Available (Whether in Full or Part)

You need to give the break-up of inward supplies on which the ITC was availed. The following are the details you need to capture:

- Import of Goods: Tax credit of IGST paid on import of goods.

- Import of Service: Tax credit of IGST paid on import of services.

- Inward supplies liable to reverse charge: You need to capture the ITC of GST paid on inward supplies liable for reverse charge such as, sponsorship services, purchase from URD, and so on, other than import of goods or services. To know more, read inward supplies liable to reverse charge

- Inward Supplies from ISD: Input tax credit received from Input Service Distributor (ISD). Read our blog post on ISD for more details.

- All other ITC: Apart from above, ITC of other inward supplies has to be captured here.

2. Details of Input Tax credit to be reversed: Under this table, you need to capture the ITC reversible on usage of inputs/input services/capital goods used for non-business purpose, or partly used for exempt supplies. Also, if the depreciation is claimed on tax component of capital goods, and plant & machinery, then the ITC will not be allowed. Such reversal needs to be captured in this table. To know more, read ITC on inputs/input services used for non-business purpose or exempt supplies

The ITC available as reported in Table 4(a) needs to be reduced by the amount of ITC to be revered as reported in above table. The balance will be your eligible ITC.

Guide to File Form GSTR-1

What is GSTR-1

Form GSTR-1 is a statement in which a regular dealer needs to capture all the outward supplies made during the month. Broadly, all the outward supplies made to registered businesses (B2B) are required to be captured at invoice level, and supplies made to unregistered business or end consumers are required to be captured at rate-wise. However, in certain exceptional scenario, even B2C transactions are required to be captured at invoice level.

How to file GSTR-1?

GSTR-1 format contains 13 tables in which the outward supplies details needs to be captured. You need not worry since all tables are not applicable for every business . Based on the nature of business and the nature of supplies effected during the month, only the relevant components of GSTR-1 are applicable, not all. Let us discuss on components of GSTR-1 format in detailed.

1. Details of GSTIN and aggregate turnover in preceding year.

In the above table 1, you need to capture the GSTIN allotted to you. Based on the GSTIN, table 2(a) and 2(b) would be auto-populated with details furnished during registration or enrollment. In table 3(a), you need to capture the aggregate turnover of previous financial year, and in 3(b), aggregate turnover of the last quarter (April to June, 2017) needs to be captured manually.

The quarterly turnover information is not to be captured in subsequent returns, and the aggregate turnover of previous financial year would be required to be submitted by the taxpayers only in the first year. From subsequent years, it will be auto-populated.

2. Taxable outward supplies made to registered persons (including UIN-holders) other than Zero Rated supplies and Deemed Exports.

In the above table, all B2B supplies (outward supplies made to a registered person) both inter-State and intra-State outward supplies should be captured at invoice level rate-wise details. This table has 3 sections: 4A, all the outward supplies except those attracting reverse charge and supplies made through e-commerce operator; supplies attracting reverse charge should be captured rate-wise in 4B, and those effected through e-commerce operator attracting collection of tax at source should be captured operator wise and rate-wise in 4C respectively.

3. Taxable outward inter-state supplies to un-registered persons where the invoice value is more than Rs 2.5 Lakh.

In above table, all inter-State B2C supplies (supplies made to unregistered dealer or end consumer), where invoice value is more than Rs. 2,50,000, you need to upload the invoice-wise and rate-wise details. Similar to table 4, you need to capture the supplies effected through e-commerce operator separately in 5B and all other interstate supplies having invoice value more than Rs. 2,50,000 to be captured in 5A. This type of supplies are referred as B2C Large.

4. Details of Zero Rate supplies and Deemed Exports

In the above table 6, the information related to exports out of India to be captured in 6A, supplies to SEZ unit or SEZ developer in 6 B, and deemed exports in 6C. The details of these supplies need to be captured at invoice-wise and rate-wise. In declaring these details, the following points needs to be taken care of:

- Shipping bill and its date. The details of Shipping Bill shall be furnished in 13 digits capturing port code (six digits) followed by unique reference number of shipping bill and its date. If the shipping bill details are not available at the time of filing GSTR-1, the same can be left blank and can be updated as amendment in Table 9 in the next tax period in which the details are available but before claiming any refund/rebate related to the said invoice.

- Any supply made by SEZ to Domestic Tariff Area (DTA), without the cover of a Bill of Entry is required to be reported by SEZ unit in GSTR-1. The supplies made by SEZ on cover of a Bill of Entry shall be reported by DTA unit in its GSTR-2 as Imports in GSTR- 2.

- In case of export transactions, GSTIN of recipient will not be applicable and it needs to be left blank.

- Export transactions effected without payment of IGST (under Bond/Letter of Undertaking (LUT)) needs to be reported as “0” under tax amount heading in Table 6A and 6B.

5. Details of taxable supplies (Net of debit notes and credit notes) to unregistered persons other than the supplies covered in table 5

In the earlier table, that is, no. 5, the taxable person had declared only the interstate outward supplies made to unregistered person (B2C Large) having invoice value more than Rs. 2.5 Lakh. In the this table, that is, Table 7, you need to capture all other supplies made to unregistered person, that is, all intra-state supplies in 7A and inter-state supplies having invoice value up to Rs. 2.5 Lakh made to unregistered dealer in 7B. In Table 7A(1), you need to capture consolidated rate-wise details of all intrastate outward supplies made to unregistered persons, including the supplies made through e-commerce operator. In 7A (2), you need to show separately the details of supplies made through e-commerce operator attracting collection of tax-at-source out of gross supplies reported in 7A (1).

Similarly, the details of inter-state outward supplies having invoice value up to Rs 2.5 Lakh need to be captured state-wise and rate-wise in 7B (1). In 7B (2), you need to separately show the details of supplies made through e-commerce operator attracting collection of tax-at-source out of gross supplies reported in 7B (1).

Please note, all the above values should be net of debit note and credit note. If there are any debit note or credit note pertaining to above mentioned supplies, ensure to adjust such values and declare only the net taxable value and corresponding tax.

6. Details of nil rated, exempted and non GST outward supplies

In the above Table 8, you need to capture the nil rated, exempted and Non GST outward supplies made during the period. These details needs to be categorized as intra-State supplies to registered person, and inter-State supplies to unregistered person in 8A to 8D as shown in the above table.

7. Details of debit notes, credit notes, refund vouchers issued during current period and any amendment to GSTR-1 filed for earlier tax periods in Table 4, 5 and 6.

In the above table, you need to capture the details of debit note, credit note and refund voucher (return of advance received) issued against the supplies already reported in:

• B2B supplies reported in Table 4,

• B2C Large supplies reported in Table 5,

• Supplies involving exports/SEZ unit or SEZ developer/deemed exports reported in Table 6.

These details needs to be capture rate-wise along with the original invoice number against the debit note or credit note issued. In the first three columns, you need to mention the details of original invoice, followed by the rate-wise details of credit note/debit note/refund voucher issued during the return period.

In table 9A, if shipping bill number and date was not declared in your earlier returns due to non-availability, you can furnish such details pertaining to export transactions effected during earlier return as amendments. If the export transactions are related to current month, the shipping details should be entered in Table 6.

In Table 9B, rate-wise details of credit note/debit note/refund voucher issued during the return period need to be captured and in table 9C, the details of amendments made through credit note/debit note/refund voucher against the invoice/advance receipt pertaining to pervious return period. Also, any debit/credit note pertaining to invoices issued before the appointed day must also to be reported in this table.

8. Details of debit note and credit note issued to unregistered person

In the above table, you need to capture the consolidated rate-wise details of debit note/credit note issued against the intra-State supplies made to unregistered person and inter-State supplies having invoice value less than Rs. 2.5 Lakhs made to unregistered person in previous return period. This is an amendment to the details declared in Table 7 of earlier return. In Table 10A and 10B, you need to capture the rate-wise details of intra-State supplies and inter-State supplies respectively. Out of the value captured in table 10A and 10B, you need to separately capture the details of supplies made through e-commerce operator in 10A (1) for intra-State and 10B (1) for inter-State supplies.

9. Details of Advances Received/Advance adjusted in the current tax period or Amendment to GSTR-1 furnished in earlier tax period

In the above table 11, you need to provide consolidated state-wise and rate-wise details related to advances received in the current period, and also the details of advances received in earlier period but adjusted in the current period. In Table 11A, capture the details of advance received for which the invoice has not been be issued. These details are need to be categorised into intra-State supplies in table 11A (1) and inter-State supplies in table 11A (2).

You also need to include information in table 11B related to adjustment of tax paid on advance received and reported in earlier tax periods against invoices issued in the current tax period. Similar to 11A, these details are also required to be categorised into intra-State supplies in Table 11B (1) and inter-State supplies in table 11B (2).

If there are any changes pertaining to details declared in table 11A to 11B in earlier return, it can be amended by furnishing the changes in Part II of Table 11.

Please note, the details relating to advances received to be submitted only if the invoice has not been issued in the same tax period in which the advance was received. If the advance and invoice is issued in the same month, the details need not be captured in table 11.

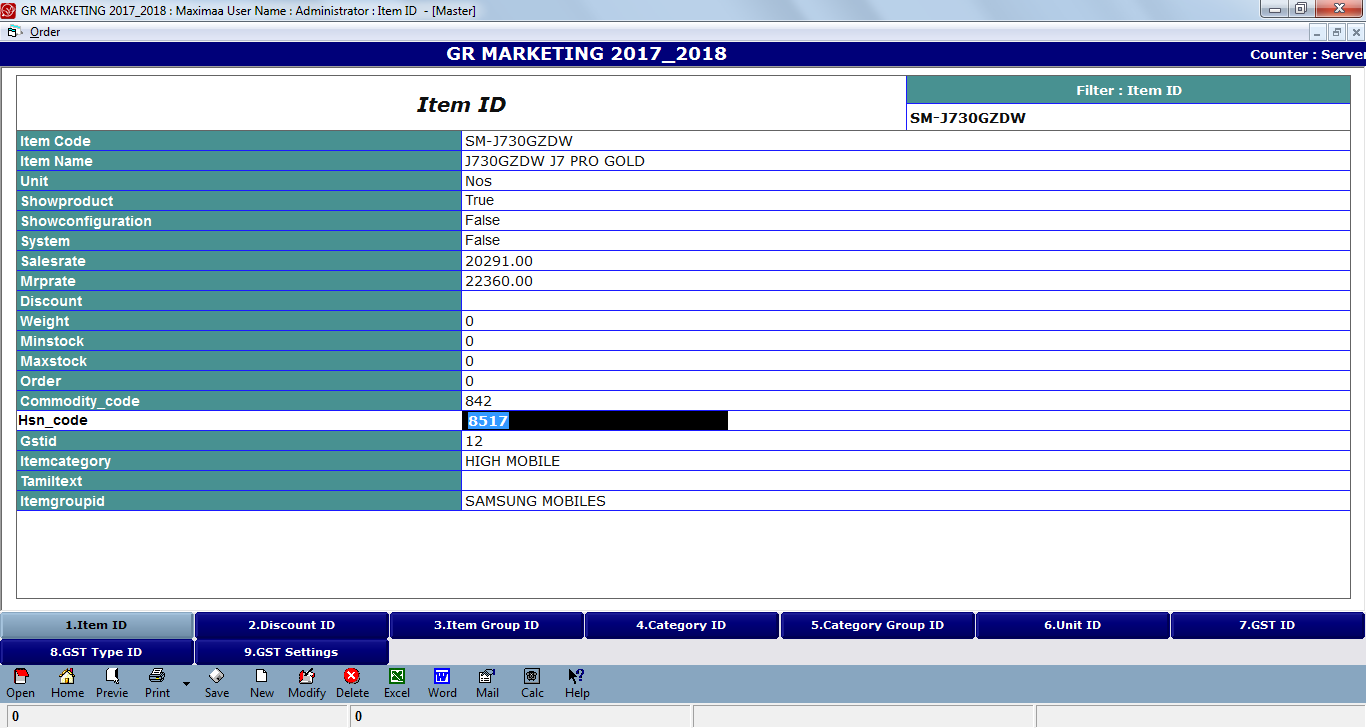

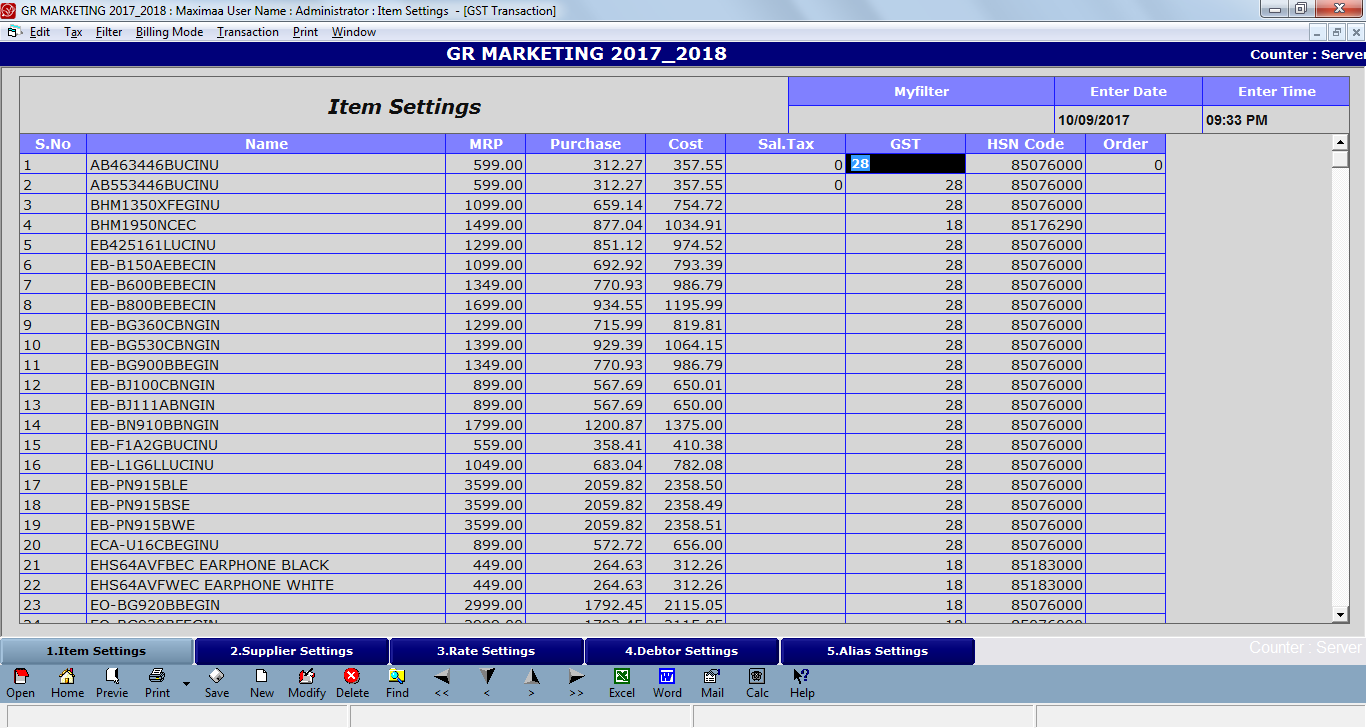

10. HSN-wise summary of outward supplies

In the above table, that is, Table 12, summary of supplies effected against a particular HSN code must be reported. It will be optional for taxpayers having annual turnover up to Rs. 1.50 Crore. However, description of goods is mandatory.

It is mandatory to report HSN code at two-digit level for taxpayers having annual turnover in the preceding year above Rs. 1.5 Cr. but up to Rs. 5 Cr., and at four-digit level for taxpayers having annual turnover above Rs. 5 Cr.

The fourth column UQC refers to unit quantity code and only the prescribed unit of measure (UOM) will be accepted by the portal. Therefore, irrespective of the UOM maintained by the tax payer, the quantity details need to be furnished using the prescribed UQC listed below:

| List of UQC | |||

| BAG-BAGS | CTN-CARTONS | MTS-METRIC TON | TGM-TEN GROSS |

| BAL-BALE | DOZ-DOZENS | NOS-NUMBERS | THD-THOUSANDS |

| BDL-BUNDLES | DRM-DRUMS | PAC-PACKS | TON-TONNES |

| BKL-BUCKLES | GGK-GREAT GROSS | PCS-PIECES | TUB-TUBES |

| BOU-BILLION OF UNITS | GMS-GRAMMES | PRS-PAIRS | UGS-US GALLONS |

| BOX-BOX | GRS-GROSS | QTL-QUINTAL | UNT-UNITS |

| BTL-BOTTLES | GYD-GROSS YARDS | ROL-ROLLS | YDS-YARDS |

| BUN-BUNCHES | KGS-KILOGRAMS | SET-SETS | OTH-OTHERS |

| CAN-CANS | KLR-KILOLITRE | SQF-SQUARE FEET | |

| CBM-CUBIC METERS | KME-KILOMETRE | SQM-SQUARE METERS | |

| CCM-CUBIC CENTIMETERS | MLT-MILILITRE | SQY-SQUARE YARDS | |

| CMS-CENTIMETERS | MTR-METERS | TBS-TABLETS | |

11. Documents issued during the tax period

In the above table, you need to capture the details of documents issued during the return, along with the starting and ending number of the document, cancelled document and net issued.

To download GSTR-1 form, please click here

Conclusion

Broadly, details required to be captured in GSTR-1 are either invoice-wise, rate-wise, or state-wise details of outward supplies made during the month. By now, you must have got some insight about the amount of information one has to furnish in filing GSTR-1, and also would have measured the effort and time required in doing so. For some reason, if the returns are not filed on-time, it will have an impact on the creditability of your business. Subsequently, it will also impact your customers since ITC depends on supplier compliance. It is high time to look for a software which will ease the businesses in meeting the compliance needs.

Match GSTR-3B with GSTR-1, GSTR-2 and GSTR-3

GSTR-3B is a summary level return, in which the consolidated value of tax liability and eligible Input Tax Credit (ITC) have to be declared, whereas in the regular returns (?), you are required to declare invoice-wise and (?) rate-wise details. The thumb rule here is that summary declared in GSTR-3B should match with details furnished in regular returns. This means, the tax paid on the basis of GSTR-3B should match with the tax liability generated in GSTR-3 of July month.

Now, you might wonder, “How can I match GSTR-3B with GSTR-1 and GST-2? How does the GST system match GSTR-3B with GSTR-3?” Let us answer your questions in detail.

How to match GSTR-3B with GSTR-1 and GSTR-2

- All Outward Supplies summary declared in Table 3 of Form GSTR-3B except the Inward Supplies liable for reverse charge should be matched with the invoice-wise details of Outward Supplies declared in Form GSTR-1.

- Similarly, ITC details declared in Table 4 of form GSTR-3B including the tax liability on Inward Supplies liable for reverse charge should be matched with GSTR-2.The details of matching of GSTR-3B with GSTR-1 and GSTR-2 are shown in the table below:

| Details of GSTR-3B | Matched with GSTR-1 or GSTR-2 | Remarks |

| Details of Outward Supplies declared in Table 3.1 | GSTR-1 | The details of Inward Supplies liable for reverse charge declared in Table 3.1 should be matched with GSTR-2. |

| Details of inter-state supplies made to unregistered persons, composition dealers and UIN holders declared in Table 3.2 | GSTR-1 | This should be matched with the Tables 4, 5, 7 and 8 of Form GSTR-1. |

| Details of eligible Input Tax Credit declared in Table 4 including Inward Supplies liable for reverse charge | GSTR-2 | This should be matched with relevant table of GSTR-2. |

| Details of exempt, nil-rated and non-GST Inward Supplies. | GSTR-2 | This should be matched with Table 7 of Form GSTR-2. |

How does the GST system match GSTR-3B with GSTR-3?

Based on the Outward Supplies submitted in GSTR-1 and Inward Supplies submitted in GSTR-2, the revised tax liability and eligible ITC gets be auto populated in Part-B of GSTR-3 as shown below.

From the details of GSTR-1 and GSTR-2, system would auto populate the correct figures of tax payable in column 2 of Table 12 of FORM GSTR-3.In column 2 to 7, the tax already paid through the electronic cash ledger and electronic credit ledger while filing GSTR-3B will be auto captured by the system. Ideally, if there is no difference between the details of output tax liability and eligible ITC furnished in GSTR-3B and the details furnished in GSTR-1 and GSTR-2, the amount of tax payable in Part B of GSTR-3 and tax paid in GSTR-3B will be the same. In such a case, you can sign and submit GSTR-3 without any additional payment of tax.

How to File Your GST Returns with simple picture flow..

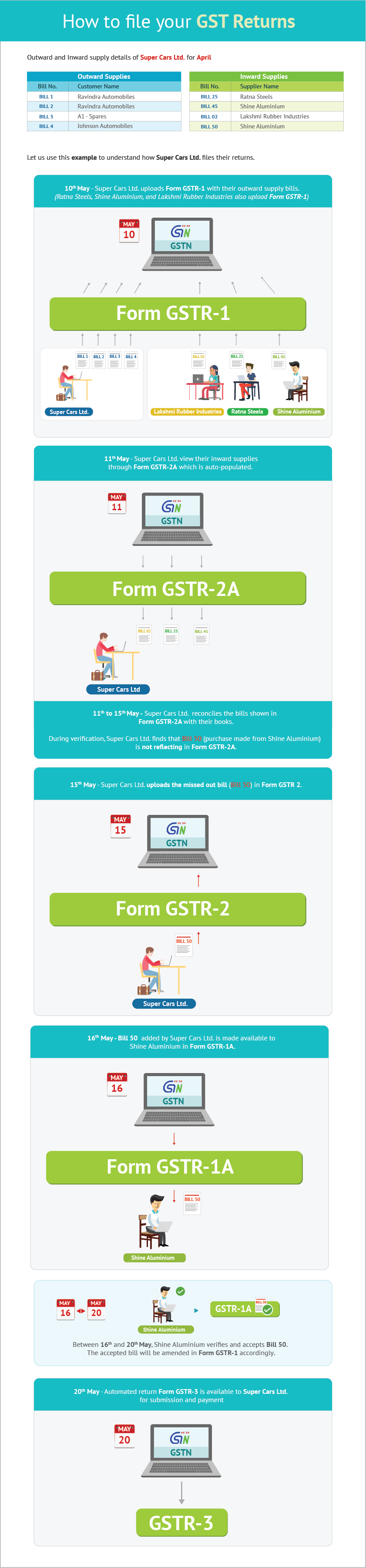

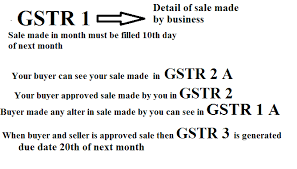

Every registered taxable person has to furnish outward supply details in Form GSTR-1 (GST Returns-1) by the 10th of the subsequent month.

On the 11th, the visibility of inward supplies is made available to the recipient in the auto-populated GSTR-2A. The period from 11th to 15th will allow for any corrections (additions, modifications and deletion) in Form GSTR-2A and submission in Form GSTR-2 by 15th of the subsequent month.

The corrections (addition, modification and deletion) by the recipient in Form GSTR-2 will be made available to supplier in Form GSTR-1A. The supplier has to accept or reject the adjustments made by the recipient. The Form GSTR-1 will be amended according to the extent of correction accepted by supplier.

On 20th, the auto-populated return GSTR-3 will be available for submission along with the payment. After the due date of filing the monthly return Form GSTR-3, the inward supplies will be matched with the outward supplies furnished by supplier, and then the final acceptance of input tax credit will be communicated in Form GST MIS-1.

Also, the mismatch input tax credit on account of excess claims or duplication claims will be communicated in Form GST MIS-1.Discrepancies not ratified will be added as output tax liability along with interest. However, within the prescribed time, if it is ratified, the recipient will be eligible to reduce this output tax liability.

_-_Insert_GSTIN,_State_Code.png)